A Secured Loan is a loan that is backed up with collateral such as a diamond rings, your house, cars, stock, bonds or some property that you own that is of equal or greater value.

This type of loan requires a borrower to pay a specified amount at the end of an agreed upon time frame. If the borrower is unable to repay the loan then the lender can sell off the asset that the borrower used to obtain the Secured Loan to recoup the money owed.

If your looking to obtain a large amount of cash a Secured Loan is usually the best way to go, especially if you need the money immediately.

Homes are normally the collateral the borrowers offer to lenders to obtain a Secured Loan. The lender then will conduct a valuation on the asset to determine it’s worth and how much money will be advanced to the borrower.

As a result the lender then takes position of the deed of the property and remains the owner of the deed until the loan is paid back. When the Secured Loan is paid back the borrower gets the deed back.

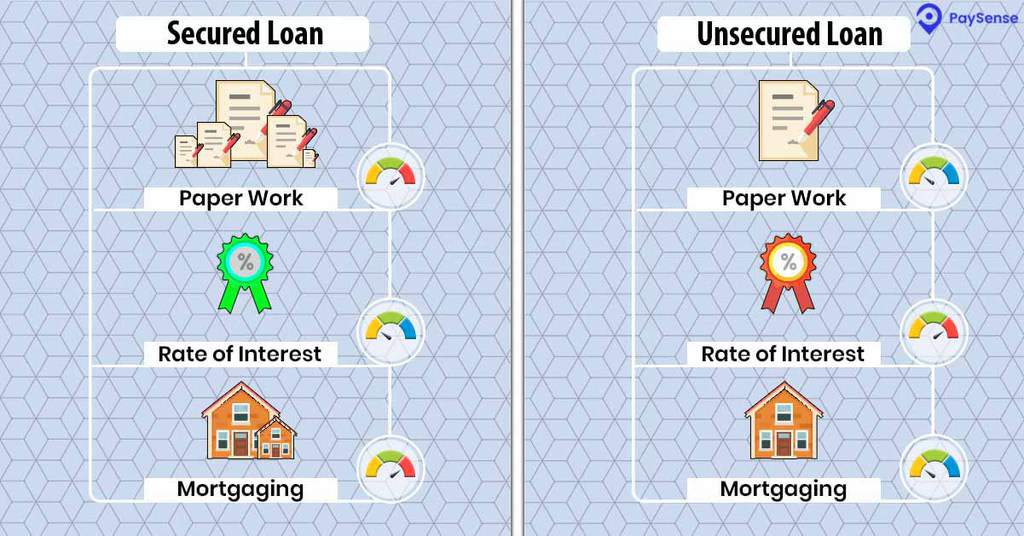

Since the level of risk to the lender is small a Secured Loan are usually the cheapest loans to obtain, conversely an unsecured loan – such as a credit card, education loan and bank note; which are not backed by any form of collateral usually carry a much higher interest rate since the lender is assuming a higher burden of risk.

- What Is Aromatherapy Vs. What Are Essential Oils?

- What is La Tomatina in Bunol, Spain Like? What to Expect at the Famous Tomato Throwing Festival

Most of the time having perfect credit is not essential when looking to obtain a Secured Loan since the value of the asset you are backing up the loan with determines how large a loan you can get; and the lender can liquidate the asset in the event a borrower defaults on the repayment agreement.

Before applying for a Secured Loan always seek the advice of an expert.