In investing, resistance is a price level that a stock has a hard time exceeding for a period of time. When a security reaches a certain price and then stays steady or drops down again, and does this several times at around the same price, this level is known as the resistance.

Following is some information on what resistance is in stock trading, and on how one can use this level to invest for success.

What is Resistance in Stock Trading?

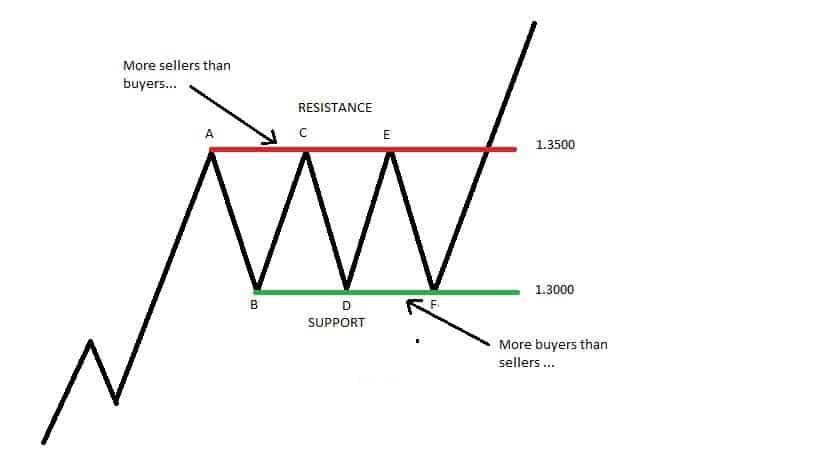

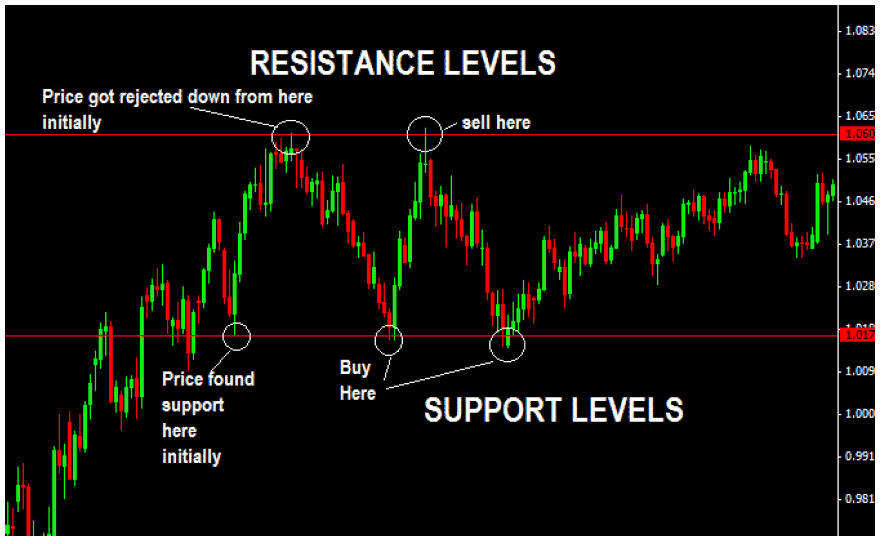

Resistance is a price level that seems to mark the upper price limit for a security over time. For example, if a security has traded between $10 and $15 for several months, and several times it has hit very close to $15 or actually come up to that mark, and then stayed at that price or dropped backed down, $15 would be the resistance for the stock.

This is the opposite of support, which is a low trading price that a security has a hard time dropping below ($10 in this example, if it has come down to, but not dropped below that level).

Investing Strategy and Resistance in Stock Trading

If the resistance mark has been confirmed several times, a stock’s breaking out through its resistance level can, to many investors, pinpoint the right amount of positive (bullish) momentum that seems to indicate a continuing rise in price (or, uptrend).

Therefore, some traders buy just above a resistance level, so that when it breaks through this price and pushes even higher, shares can be sold at better prices for greater returns.

This strategy works whenever stock does rise up after breaking out. A stop order to buy just above a solid resistance level will allow a trader to take on shares when the stock rises up past the level that it has historically had a hard time beating, which is also quite often a time that it shows strong upward momentum.

This stock trading technique is generally more effective if the resistance level has been well established.

How to Spot Resistance Level for Stock

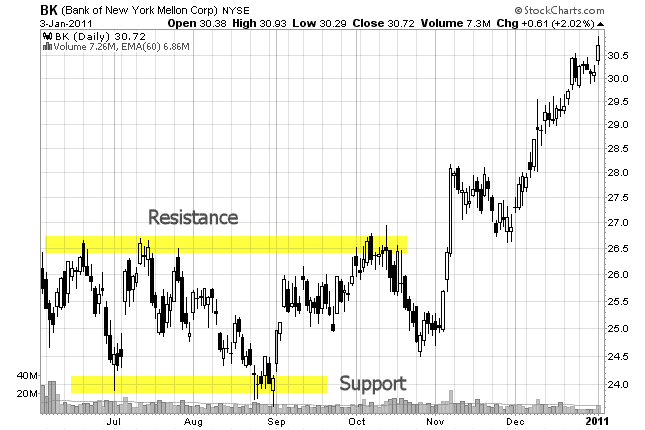

Referring to free stock charts at online trade sites like E-Trade, Scottrade, TradeKing, and TD Ameritrade will reveal how securities have traded to investors. If a given security has a certain price level that, on several tries, it has been unable to break, that is the resistance level.

This is not simply the highest price reached over a period of time, but rather a mark that stock price has come very close to or hit, but barely exceeded if at all in several attempts.

Not all stock’s have clear cut resistance levels at all times (in fact, most do not), but when a security does, if conditions are right, buying once a stock breaks out and beats this level can be a successful investing technique at times, as often, the momentum that pushes the price past this level will keep it moving up even higher.