Just as in the stock market, forex investors often use a strategy called the hedging transactions to reduce some of the risk associated with the trading. Many people think of hedging as purchase a policy of insurance for their stance of currency…

Just as in the stock market, forex investors often use a strategy called the hedging transactions to reduce some of the risk associated with the trading. It more or less in the same way. Using instruments of investment known as the financial instruments futures, forex traders can rest quietly knowing that all losses will be covered by the backup plan.

A type of financial instrument in the term that many forex traders use to cover a position is the contract term, which is an agreement to the exchange rate of one currency by another with a date specified term to the price of the last closing date. Currency futures contracts are bought and sold on the market of the fair forex as any other instrument such as shares or the currencies.

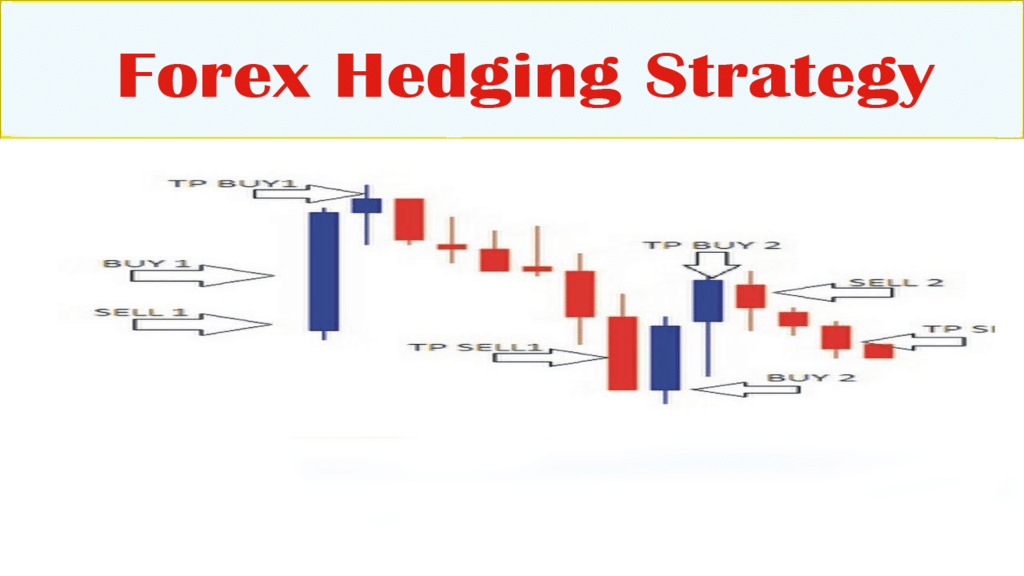

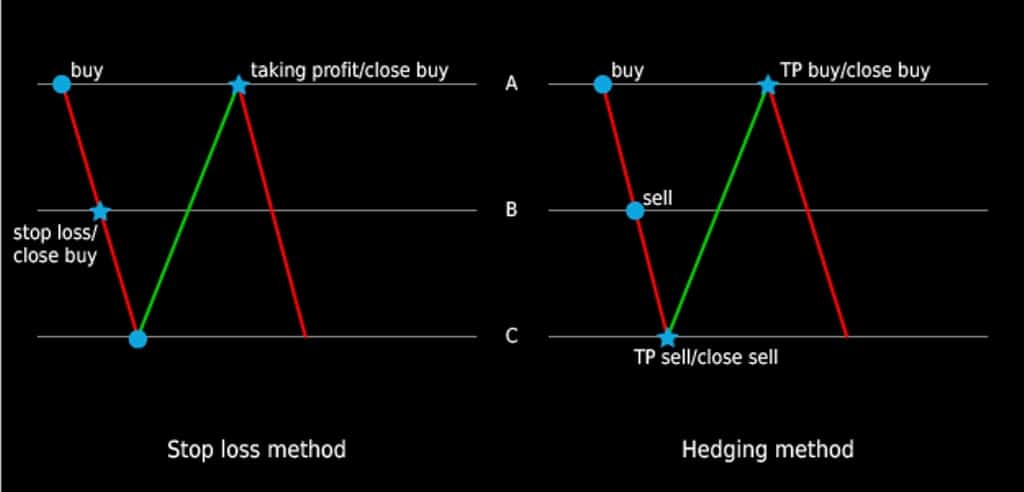

For example, say that you used to use dollars to take a long position in euro on the forex market, but you are worried that the price of the EUR fell against the dollar.

One thing you could do is to agree to a contract term on the dollars using euros. As external factors affect the price of Exchange, futures prices climb and descend as well, allowing your euro-to-dollars contract to offset your long position in euros.

If the euro weakens, the futures contract price goes up, and vice versa. Thus, you have therefore eliminated the risk of your investment of money.

Another form of hedging in forex market is regularly practised by companies that Exchange internationally with many customers in Europe. A weakening of the euro cost it money in the long run because the original price listed in euros does not result in as much $. Taking a long position in dollars using euros, the company would make just as much money on the forex lost to fall on the value of the euro.

Similarly, if it would lose money on the the forex market because of a decline in value of the dollar, the company the offset by increasing profits due to the greater value of the euro on the sale of its products.

The hedging transactions are a powerful tool that those who take the time to use them.